Sydney Airport Issued a 10-Year Senior Secured Bond

Sydney Airport launched a new 10-year fixed rate note on April 19, 2024, receiving investment-grade ratings of Baa1 from Moody’s and BBB+ from S&P. The coupon is fixed at 5.90% p.a.

This offering presents investors with an appealing opportunity to tap into Australia’s foremost airport. With the anticipated uptick forecasted in global economic activity and trade volumes, there is a projected surge in demand for both passenger and cargo transportation via air routes over the next 20 years. This increase presents growth prospects for airport operators and associated industrial infrastructure.

Sydney Airport

Sydney Airport, Australia’s busiest aviation hub and primary gateway to the nation, operates under a long-term lease granted by the Commonwealth Government. Nowadays, Sydney Airport has transitioned into private ownership after being acquired by Sydney Airport Corporation Limited (SACL) in 2023, leading to its delisting from the Australian Securities Exchange (ASX).

Financial Performance

Sydney Airport’s 2023 annual report highlights a substantial 45% increase in annual earnings, reaching $1.49 billion, reflecting the aviation sector’s resurgence. This growth stems primarily from a notable rise in passenger numbers, which surged from 29.1 million to 38.6 million year-over-year. Additionally, revenue streams from aeronautical fees, retail, car rentals, property leases, and parking fees have experienced significant increases. These factors collectively contributed to a 61% growth in earnings before interest, taxation, depreciation, and amortization (EBITDA) compared to 2022.

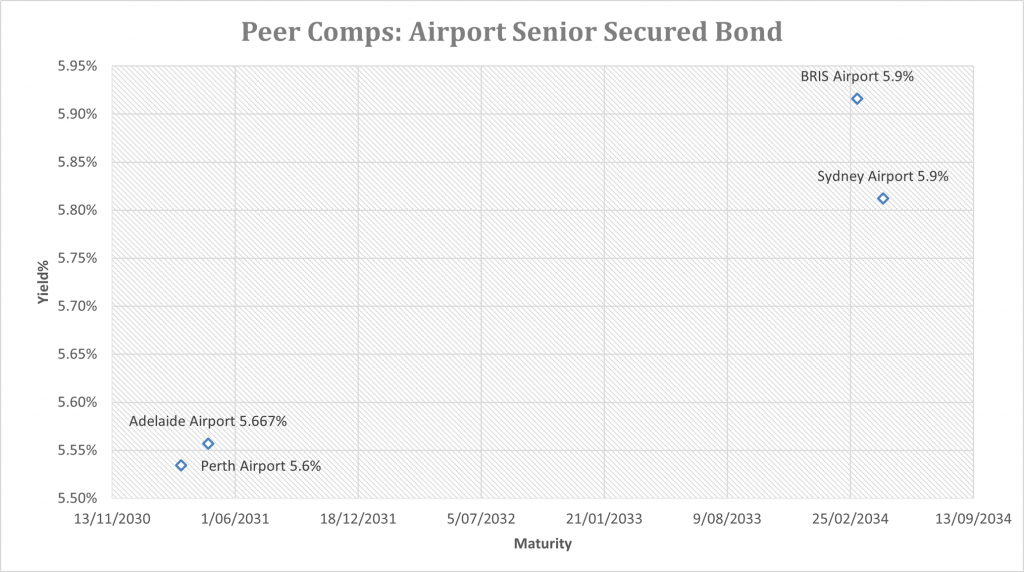

Relative Value

The Graph below shows recently issued senior secured bonds of Australian airports. The new senior secured transaction of Sydney Airport initially appeared attractive at the initial price guidance. However, as the margin narrowed, it descended deep below the Brisbane Airport.