Qantas Airways Ltd. has recently issued a 10-year investment-grade medium-term note under its AUD 2.5 billion debt securities program. The transaction saw strong demand in the market, with bids reaching AUD 2.16 billion, though the final issuance size was capped at AUD 500 million. The coupon rate was set at 5.90% p.a., with the margin tightening from 220 basis points to 200 basis points due to the high level of interest. The bond price quickly rose above $101, trading positively in the grey market, reflecting strong investor confidence.

Company Overview

Founded in 1920, Qantas Airways Ltd. is Australia’s national airline and one of the world’s oldest, renowned for its strong safety record, premium service, and extensive domestic and international network. The airline operates under two key brands: Qantas, a full-service carrier, and Jetstar, its low-cost subsidiary. As a member of the oneworld alliance, Qantas connects Australia to major global markets. The airline is committed to innovation, sustainability, and fleet modernization, with a goal of achieving net-zero carbon emissions by 2050.

Market Recovery

Since the easing of COVID-19 restrictions in 2022, Qantas and the broader Australian aviation industry have seen a significant domestic recovery, driven by strong demand for travel. However, international capacity remains below pre-pandemic levels, constrained by rising fuel costs, inflation, and labor shortages. While domestic competition has intensified, the overall industry is in recovery, though it continues to face challenges from shifting market dynamics and economic pressures.

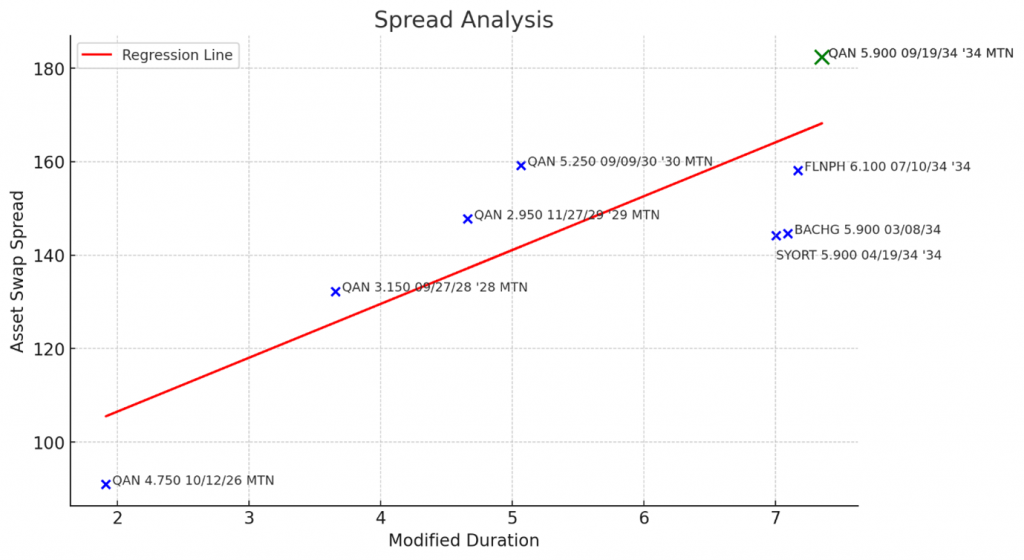

Spread Analysis

The recent bond issuance sheds light on an important aspect of spread analysis. The Qantas bond, with a modified duration of 7.353, offers a spread of around 182 basis points, placing it well above peers in the same maturity range (please refer to the chart below, prepared on 13 Sep 2024). This higher spread reflects the market’s demand for increased returns to compensate for the longer-term exposure to interest rate risk. The bond has already appreciated in value in the grey market, benefiting from a gradual decline in the AU 10-year treasury note.

As illustrated in the chart, Qantas’s long-term bonds are priced with spreads that effectively reflect the risk profile of their durations. This demonstrates Qantas’s ability to issue bonds at competitive spreads, reinforcing its financial strength in navigating current market conditions relative to its peers.