The Commonwealth Bank of Australia (CBA) successfully priced a AUD 1.5 billion subordinated capital bond with a 15-year maturity. The bond features a non-call period of 10 years with a fixed coupon rate of 6.152%. The issuer has a call option exercisable in 2034. If not called, the bond will transition to a floating coupon rate of BBSW + 165 basis points. After this, the bond will be callable on a quarterly basis, with a final maturity date of 2039.

The issuance attracted strong investor demand, achieving an oversubscription of AUD 3.6 billion and a scale-back to 41%. The final issuance size remained at AUD 1.5 billion.

Australia’s leading bank

The Commonwealth Bank of Australia (CBA), established under the Commonwealth Bank Act in 1911 and operational since 1912, originally functioned as both a savings and general banking institution.

Today, CBA has evolved into Australia’s largest bank and a major financial group, with over 800,000 shareholders and a workforce of 52,000 employees. With a market capitalization of approximately AUD 259 billion, the bank operates more than 700 branches, serving over 17 million customers. Its diverse business portfolio contains retail banking, home loans, commercial services, and insurance.

According to the Commonwealth Bank of Australia’s (CBA) annual report for the year ending June 30, 2024, the bank’s Common Equity Tier 1 (CET1) capital ratio reached 12.3%, significantly higher than the regulatory minimum requirement of 10.25%. This exceeds the minimum requirement by AUD 9.8 billion, highlighting the bank’s strong risk management capabilities.

Additionally, the bank’s Liquidity Coverage Ratio (LCR) stood at 136%, and the Net Stable Funding Ratio (NSFR) was 116%, both well above the 100% regulatory minimum. These reflect CBA’s strong performance in liquidity management and funding stability.

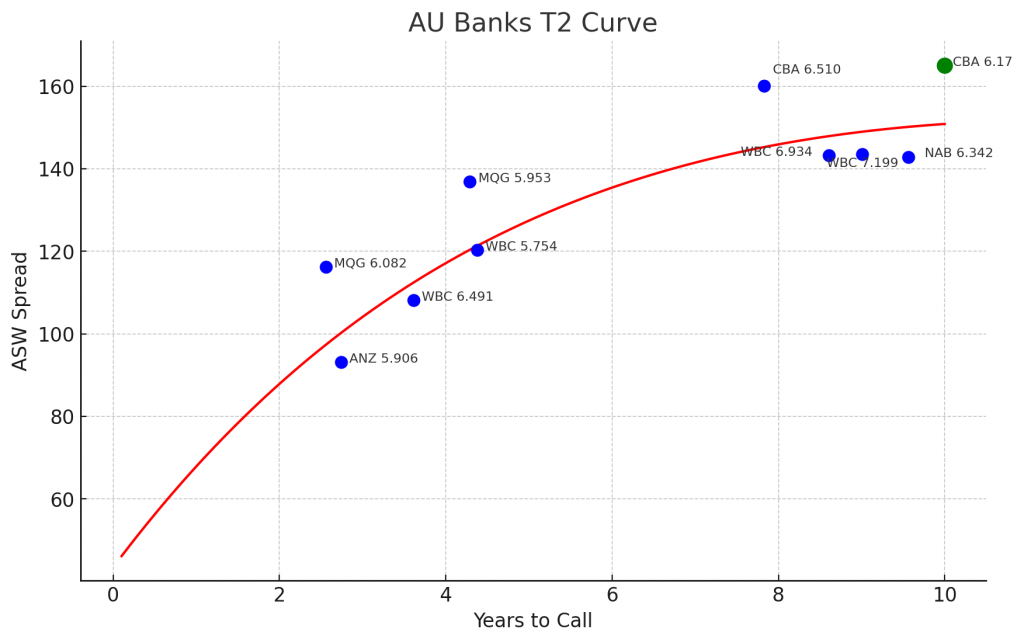

Spread Analysis

The pricing of this bond reflects its strong market position, driven by the issuer’s financial stability and market reputation. From the yield curve, it can be observed that this bond (marked in green) is priced slightly above the red yield curve, indicating that it offers a competitive spread compared to other bonds with similar maturities. This suggests that the bond carries relatively low credit risk and that investors have confidence in the issuer’s creditworthiness. In the current market environment, the bond stands out by offering an attractive premium. Its solid credit and strong investor demand ensure that this issuance has a significant competitive advantage within the industry.