Barclays PLC (UK) issued two tranches of AUD 500 million subordinated bonds: a fixed-to-floating rate bond and a floating rate bond. The fixed-to-floating bond offers a 6.158% annualized coupon for 5.5 years with semi-annual interest payments. If the issuer does not call back after 5.5 years, the bond will switch to a floating annualized coupon rate of 3-month BBSW + 2.00%, with quarterly interest payments. The floating rate bond features a coupon of 3-month BBSW + 2.00%, also with quarterly interest payments. Both bonds achieved significant oversubscription—AUD 2.95 billion and AUD 2.9 billion, respectively—resulting in scale-backs to 17% and highlighting strong market demand, with final issuance sizes capped at AUD 500 million each. Both bonds have a maximum maturity of 10.5 years, with final maturity in 2034.

According to Barclays’ Q3 2024 report:

CET1 Ratio: The Common Equity Tier 1 (CET1) ratio reached 13.8%, significantly above the regulatory minimum requirement of 10.25%. This underscores the bank’s strong risk management capabilities, efficient capital utilization, and reduced capital consumption.

Liquidity Coverage Ratio (LCR): The LCR stood at 170.1%, well above the regulatory threshold of 100%, reflecting a liquidity reserve far exceeding short-term funding requirement. This provides a robust safeguard against market volatility.

Net Stable Funding Ratio (NSFR): The NSFR was 135.6%, also surpassing the 100% regulatory minimum. This demonstrates stable and sufficient long-term funding to support sustained asset growth and operational activities.

These highlight Barclays’ strong liquidity management and funding stability, reinforcing its ability to navigate volatile market conditions while ensuring operational continuity.

Historical Overview of Barclays Bank:

Barclays traces its origins back to 1690 when two goldsmith bankers, John Freame and Thomas Gould, began their business on Lombard Street, London. In 1736, Freame’s son, Joseph, brought his brother-in-law, James Barclay, into the partnership, marking the beginning of the “Barclays” name that has become synonymous with the business ever since. Today, Barclays operates in over 40 countries worldwide, employing approximately 83,500 staff. The bank provides a comprehensive range of services, including funds transfer, lending, investment, and asset protection, to clients globally.

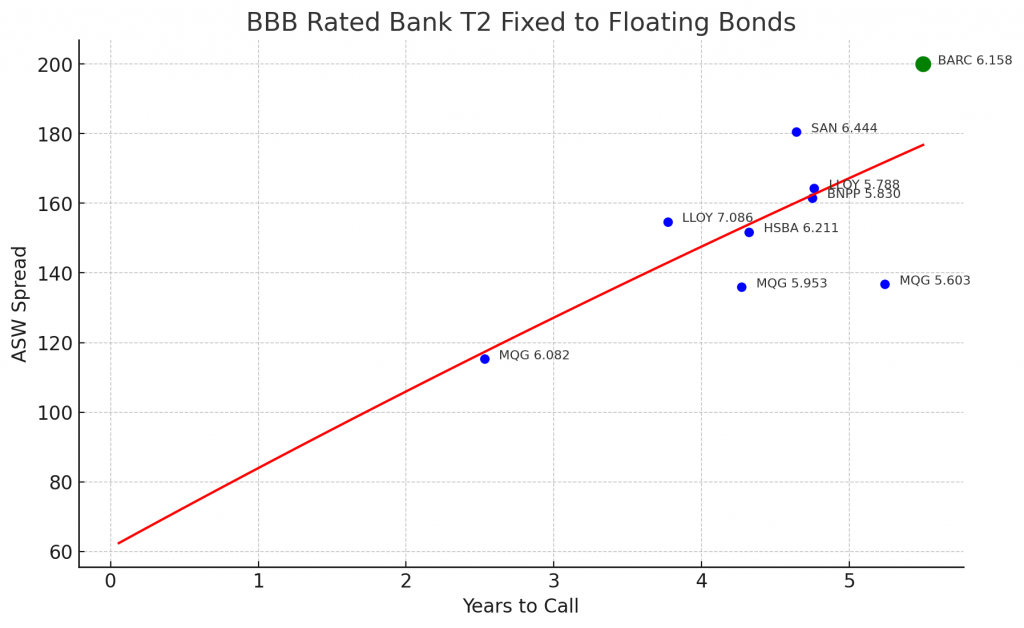

Spread Analysis:

These two bonds offer higher return potential, with a wider spread indicating they provide greater returns compared to other Kangaroo bonds. Only few bonds that can achieve a 200-basis point spread on the pricing day. Kangaroo bonds are issued by foreign corporations, governments, or institutions in the Australian market. Although these foreign entities may have strong credit ratings, investors demand higher spreads as compensation for the uncertainties associated with geographical, political, and economic factors.