The Bendigo and Adelaide Bank announced its intention to issue AUD 250 million in Tier 1 capital notes on February 26, 2024, with a margin rate of 3.2% in addition to the three-month bank bill swap rate. This offering yields a total return of 7.53% (with the three-month BBSW at 4.335%, February 23, 2024), and is fully franked at a 30% level.

For investors, comprehending the nuances of AT1 capital—including their functionality, the rationale behind their issuance by banks, and the critical CET1 ratio—is essential before embarking on investment ventures.

AT1 capital, also recognized as Additional Tier 1 bonds, are pivotal for banks for several reasons:

Functionality: AT1 capital often have no fixed maturity and can be perpetual, enhancing a bank’s capital base and providing a loss-absorption mechanism.

Regulatory Compliance: In alignment with Basel III and other regulatory standards, these bonds contribute towards a bank’s Additional Tier 1 capital, fortifying its buffer against unforeseen losses and promoting financial stability.

Recapitalization Mechanism: In financial downturns, AT1 capital may convert into equity or face write-downs to bolster the bank’s solvency, circumventing government rescues.

While these bonds present higher risks, their elevated yields attract investors seeking substantial returns. For banks, AT1 capital diversify funding sources and optimize capital structures, thereby fortifying their capital position, augmenting loss absorption capabilities, and appealing to investors desiring higher yields.

Delving into AT1 capital’s core risk reveals the pivotal role of the Common Equity Tier 1 (CET1) ratio. This ratio, often set by regulatory authorities like the Australian Prudential Regulation Authority (APRA) to exceed Basel III’s standards, necessitates banks to maintain their CET1 capital at a minimum of 8% of risk-weighted assets. A breach below this threshold could activate the loss absorption mechanism, outcome investors ideally avoid.

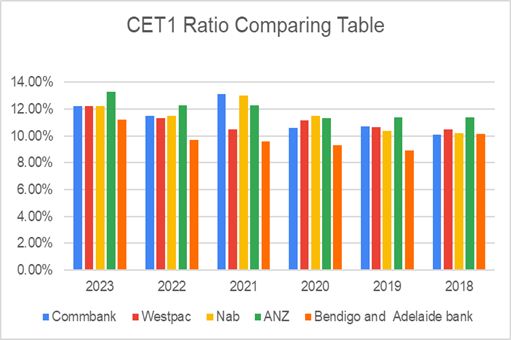

Evaluating the CET1 ratio of banks, particularly Bendigo and Adelaide Bank, is imperative for risk assessment. This ratio, discernible in banks’ financial disclosures, encapsulates common shares, retained earnings, and other components against risk-weighted assets. Though seemingly straightforward, the CET1 ratio’s calculation is influenced by a myriad of factors including capital composition, asset quality, and regulatory changes.

Over the past five years, Bendigo and Adelaide Bank has demonstrated a steady increase in its CET1 ratio, from 8.92% in 2019 to 11.2% in 2023. Despite not surpassing the CET1 ratios of Australia’s four major banks, its consistent growth and the competitive returns on its capital notes products offer a balanced proposition for investors.