BNP Paribas successfully priced an AUD 1 billion Kangaroo subordinated bonds on 26/11/2024: a fixed-to-floating rate bond and a floating rate bond. The fixed-to-floating bond offer a 6.198% annualized coupon for 7 years with semi-annual interest payments. If the issuer does not call back after 7 years, the bond will switch to a floating annualized coupon rate of 3-month BBSW+2.00%, with quarterly interest payments. The floating rate bond features a coupon of 3-month BBSW+2.00%, also with quarterly interest payments.

Both bonds achieved significant oversubscription—AUD 2.1billion and AUD 2.05 billion, respectively—resulting in scale-backs to around19% and 29%, highlighting strong market demand, with final issuance sizes capped at AUD 400 million of fixed to floating and AUD 600 million of floating. Both bonds have a maximum maturity of 12 years, with final maturity in 2036.

BNP Paribas, with a market capitalization of €103.41 billion in 2024, is the second-largest bank in Europe, managing total assets of €2.594 trillion. As the leading bank in the European Union, BNP Paribas excels due to its integrated and diversified business model, which is strategically structured across three core operating divisions. This complementary framework empowers the bank to meet the evolving needs of its clients while delivering consistent and sustainable performance.

The bank serves a broad client base, including individuals, associations, entrepreneurs, SMEs, large corporations, and institutional clients, by providing a wide range of financial solutions such as financing, investment, savings, and protection services. BNP Paribas’ long-term commitment to guiding and advising its clients ensures that it plays a pivotal role in bringing their projects to fruition.

Highlights from BNP Paribas Q3 2024 Report:

CET1 Ratio: The common Equity Tier 1 (CET1) ratio reached 12.7%, significantly above the regulatory minimum requirement of 10.25%. This high level of capital serves as a buffer to absorb potential losses, ensuring resilience in adverse economic conditions while supporting growth initiatives.

Liquidity Coverage Ratio (LCR): The LCR stood at 124%, well above the regulatory threshold of 100%, the bank maintains a substantial liquidity reserve. This ensures the ability to meet short-term obligations without reliance on external funding, enhancing financial stability during market volatility.

Net Stable Funding Ratio (NSFR): The NSFR was 116%, also surpassing the 100% regulatory minimum. This demonstrates an ability to maintain stable operations while supporting ongoing lending and investment activities.

The cost of risk remains low and stable at 31 basis points, reflecting effective risk control measures and a high-quality loan portfolio. This highlights disciplined credit risk management, contributing to consistent earnings and operational stability.

Spread Analysis

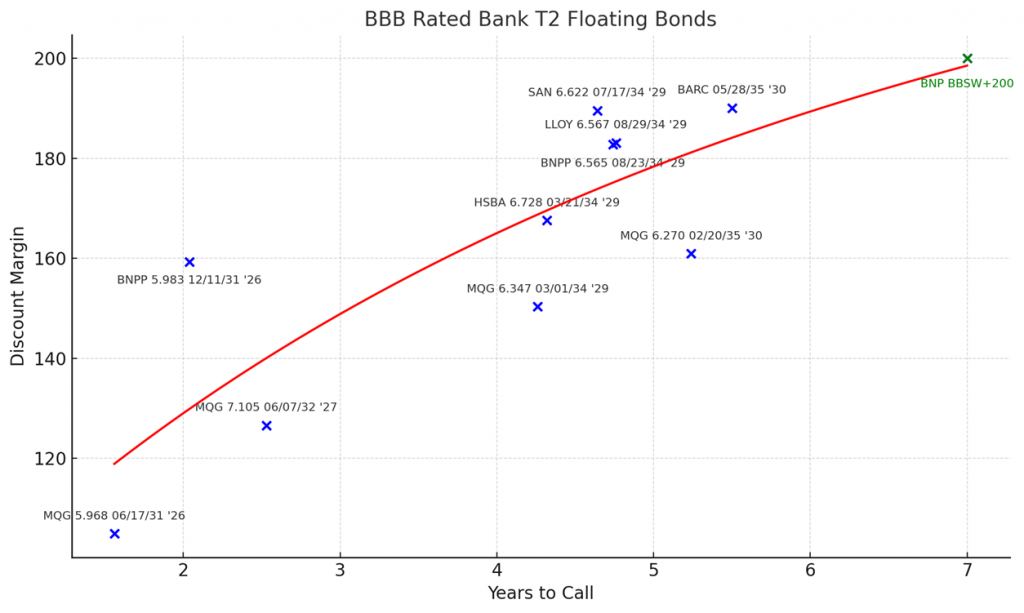

BNP Paribas’ floating-rate bond, offering BBSW + 200 bps, is positioned in the upper-right of the yield curve, slightly above the benchmark line, underscoring its competitive yield. This reflects its ability to deliver stable returns. The discount margin indicates that the bond is priced at a fair market value, highlighting strong investor demand and market confidence.

In comparison, bonds like the MQG’s 10yr floating rate bond offers BBSW+195bps, it does not offer the same level of potential returns as BNP Paribas’ bond. BNP Paribas’ bond, with its BBSW + 200 bps spread, is positioned to better capitalize on a rising interest rate environment.

Moreover, BNP Paribas’ robust capital position provides superior risk buffer, positioning it as a more stable investment compared to other BBB-rated bank bonds. This unique combination of competitive yield, risk control, and dynamic interest rate adjustments makes BNP Paribas bonds an optimal choice for investors seeking both consistent income and long-term value.