Crédit Agricole successfully launched a 10-year non-call 5-year (10NC5) Tier 2 AUD subordinated bond, pricing AUD 600 million on 09/01/2025: a fixed-to-floating rate bond and a floating rate bond. It is the second-largest bank in France and the third-largest bank in Europe, ranked just below HSBC and BNP Paribas.

The fixed-to-floating bond offer a 6.064% annualized coupon for 5 years with semi-annual interest payments. If the issuer does not call back after 5 years, the bond will switch to a floating annualized coupon rate of 3-month BBSW+2.05%, with quarterly interest payments. The floating rate bond features a coupon of 3-month BBSW+2.05%, also with quarterly interest payments.

Both bonds achieved oversubscription—AUD 390 million and AUD 660 million, respectively—resulting in scale-backs to around 64% and 53%, highlighting strong market demand, with final issuance sizes capped at AUD 250 million of fixed to floating and AUD 350 million of floating. Both bonds have a maximum maturity of 10 years, with final maturity in 2036.

Crédit Agricole, one of the largest banking groups in Europe and globally. And is a global provider of banking and financial services headquartered in Montrouge, Ile-de-France, France. It offers a wide range of services, including retail banking, asset management, insurance, private banking, and corporate and investment banking. It is also a reference bank for companies in international trade and offers them a complete range of services tailored to developing internationally as well as a major support system around the world. Being the bank of choice for almost 1 out of every 2 companies in France, the Group operates in 46 countries and has 154 000 employees and 54 million customers.

Highlights from Credit Agricole latest Q3 2024 Report:

The Common Equity Tier 1 (CET1) ratio, a key measure of a bank’s core capital relative to its risk-weighted assets, stands at 11.7%. This marks a 0.1 percentage point increase compared to the previous quarter, showcasing steady growth in its capital buffer. Notably, this ratio exceeds the Supervisory Review and Evaluation Process (SREP) requirement by 3.1 percentage points, further highlighting the bank’s strong capital adequacy and resilience to financial shocks.

Additionally, the leverage ratio remains stable at 3.8% compared to the previous quarter. This is 0.8 percentage points above the minimum regulatory requirement, showing Credit Agricole’s commitment to maintaining a conservative and compliant leverage position.

The Loan Coverage Ratio stands at an impressive 152%, well above the regulatory threshold of 100%, reflecting the bank’s conservative approach and its ability to absorb potential credit losses. This high coverage ratio ensures Credit Agricole remains well-prepared to manage credit risk while supporting the stability of its loan portfolio.

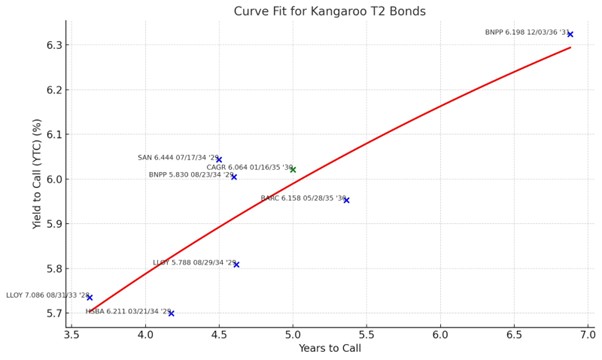

The Yield to Call (YTC) of Crédit Agricole bonds is similar to other major international banks like SAN 6.444% and BNPP 5.830%, with yield on the bond is higher than the same maturity on the overall market yield curve.

A higher yield would make the product more attractive, and the liquidity in the market would be much better than that of other similar bonds, reducing the need for investors to worry about liquidity risk.

With a “Years to Call” of 5 years, CAGR bond strikes a balance between short-term and long-term investments. It mitigates the interest rate risks associated with longer-term bonds like BNPP (6.198%, 7 years) while offering potential returns compared to medium-term alternatives like LLOY (4 years).