NAB has launched a new 15-year AUD Tier 2 subordinated bond with a 10-year non-call feature. The bond offers a fixed coupon of 6.342% p.a. for 10 years, paid semi-annually.

This is noteworthy given that the demand for Australian bank Tier 2 bonds significantly exceeds the supply. The issue spread of 200 bps over the asset swap spread reflects a wider margin compared to similar bonds issued by other major Australian banks last year. Comparable bonds from these banks typically trade around ASW+165 basis points, driven by strong demand. Another Westpac bond trades at the highest margin of +190 basis points, indicating that NAB’s pricing is relatively fair and includes a modest new issue premium, incentivising investors to participate in the primary transaction.

NAB

National Australia Bank (NAB) stands as one of Australia’s four largest financial institutions in terms of market capitalization, earnings, and customer base. On May 27, 2024, Fitch Ratings upgraded the senior unsecured ratings for the Big Five banks by one notch, elevating NAB’s senior unsecured rating from A+ to AA-. This follows a prior upgrade by Moody’s on March 6, 2024, where ANZ, NAB, and WBC were raised from Aa3 to Aa2. In 2024, NAB ranks as the world’s 30th-largest bank by market capitalization and the 47th-largest by total assets. The bank has maintained stable credit ratings of Aa2/AA-/AA- from Moody’s, S&P, and Fitch, respectively.

Financial report

Financially, NAB reported a net profit of $3.49 billion in their 2024 half year result, reflecting a 1.4% increase from the previous half-year. The Group’s financial position has been bolstered in preparation for a potentially more challenging economic and operating environment. With a Common Equity Tier 1 (CET1) capital ratio of 12.15%, NAB is well-positioned to absorb losses, ranking in the top quartile of banks globally.

Regarding NAB’s funding and liquidity, the average Liquidity Coverage Ratio (LCR) stood at 139% in May 2024, and the Net Stable Funding Ratio (NSFR) was 118% for the first half of 2024, both significantly exceeding regulatory minimums. The Group’s net interest margin (NIM) increased by 1 basis point (bp) half-on-half, while net interest income (NII) of $8.40 billion marked a 0.8% rise compared to September 2023.

Relative Value

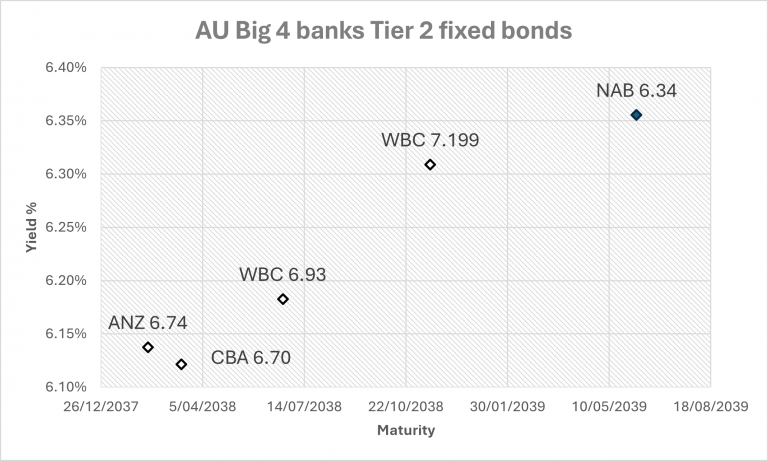

The following graph depicts subordinated bonds issued by the four largest banks in Australia. The newly issued bonds by NAB are highlighted in blue at the top right corner. With an initial guided margin of +210 basis points, the final pricing was 10 basis points tighter than initially projected. This represents a favourable opportunity compared to an average of +165 basis points for existing major bank tier 2 bonds.

Figure 1AU Big 4 banks Tier 2 Fixed Bonds (29-May-2024)