QBE Insurance Group has issued A$250 million in floating rate Tier 2 subordinated notes, expanding its Tier 2 capital base following two tranches released in September. This latest issuance, priced at a spread of 3-month BBSW +180 basis points, yields an initial rate of approximately 6.23%. Strong investor interest drove the order book to over A$2.19 billion, resulting in the issuance being scaled back to around 11% of demand. The notes mature in 12 years, with a call option after seven, and are expected to receive BBB ratings from both Fitch and S&P.

QBE Insurance Group Limited is a leading global insurer offering a diverse portfolio of insurance and reinsurance products across 27 countries. Specializing in specialty lines, property, and casualty insurance, QBE is a prominent player in the sector with a market capitalization of approximately AUD 28.59 billion as of 14 November 2024. The company’s operational efficiency is reflected in its Combined Operating Ratio (COR) of 93.8% for the first half of 2024, demonstrating strong underwriting and expense management capabilities. Additionally, QBE maintains a conservative financial structure, as evidenced by a debt-to-equity ratio of 0.30, highlighting prudent leverage and a solid capital foundation. These metrics underscore QBE’s disciplined approach to growth and risk management, cementing its reputation as a financially stable and resilient insurer in global markets. (2024 Half Year Report, QBE)

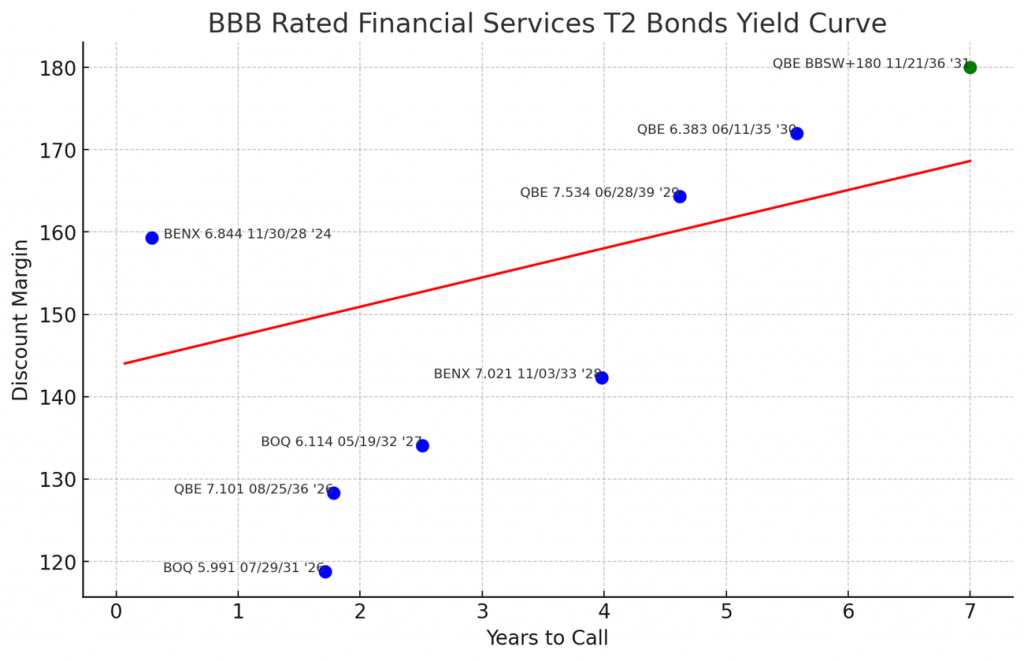

The yield curve for BBB-rated financial services Tier 2 bonds underscores QBE’s recent issuance as competitively positioned, offering a discount margin of 180 basis points over the benchmark BBSW rate. This premium, relative to other QBE bonds and those of peers like BOQ and Bendigo in the floating rate space, reflects both strong investor demand and favorable pricing conditions. The bond’s position on the upward-sloping yield curve aligns with its tenor, and it was issued with a modest concession, enhancing its appeal. Following its launch, the bond experienced rapid price appreciation, increasing by approximately half a percentage point on the second trading day. Overall, QBE’s new issuance offers an attractive yield for investors seeking solid returns from a reputable issuer in the Australian financial sector.