Origin Energy Finance Limited, under its U.S.$10 billion Euro Medium Term Note Programme, has successfully issued a new A$500 million 7-year senior secured bond, guaranteed by Origin Energy Limited (Baa2/Stable, Moody’s). This issuance attracted robust investor demand, with the final order book exceeding A$1.18 billion, resulting in a scale-back to 42%. The bond carries an annual coupon of 5.35% and offers a spread of 165 basis points above the swap rate, tightened from initial guidance of 175 basis points.

Company Overview and Credit Profile

Origin Energy, a top-50 ASX-listed company with a market capitalization of approximately A$17.1 billion, operates across three primary segments:

- Energy Markets: The largest energy retailer in Australia, serving 4.7 million customers and operating significant power generation assets, including renewable and gas-fired plants.

- Integrated Gas: Origin holds a 27.5% stake in Australia Pacific LNG (APLNG), a major liquefied natural gas exporter, which underpins its earnings.

- Octopus Energy: Origin owns a 22.7% stake in one of the fastest-growing energy technology companies, providing exposure to innovative renewable energy solutions.

Moody’s recently affirmed Origin’s long-term credit rating at Baa2 with a stable outlook, citing strong liquidity, disciplined financial management, and the company’s ability to navigate Australia’s transition to net-zero emissions. In FY2024, Origin’s funds from operations (FFO) to net debt ratio stood at 86%, well above Moody’s upper tolerance of 40%, highlighting its robust financial profile.

Australia’s Energy Sector Outlook

Australia’s energy sector is undergoing a major transformation, driven by the transition to net-zero emissions by 2050. As renewable energy sources like wind and solar increasingly displace coal and gas, companies must adapt to fluctuating market conditions and evolving regulatory frameworks. Origin Energy is well-positioned to navigate this shift due to its investments in renewable generation and battery storage, targeting 4-5 GW of additional capacity by 2030. With rising demand for cleaner energy sources and increasing policy support for decarbonization, the sector presents substantial growth opportunities for companies like Origin that are committed to future energy solutions.

Spread Analysis

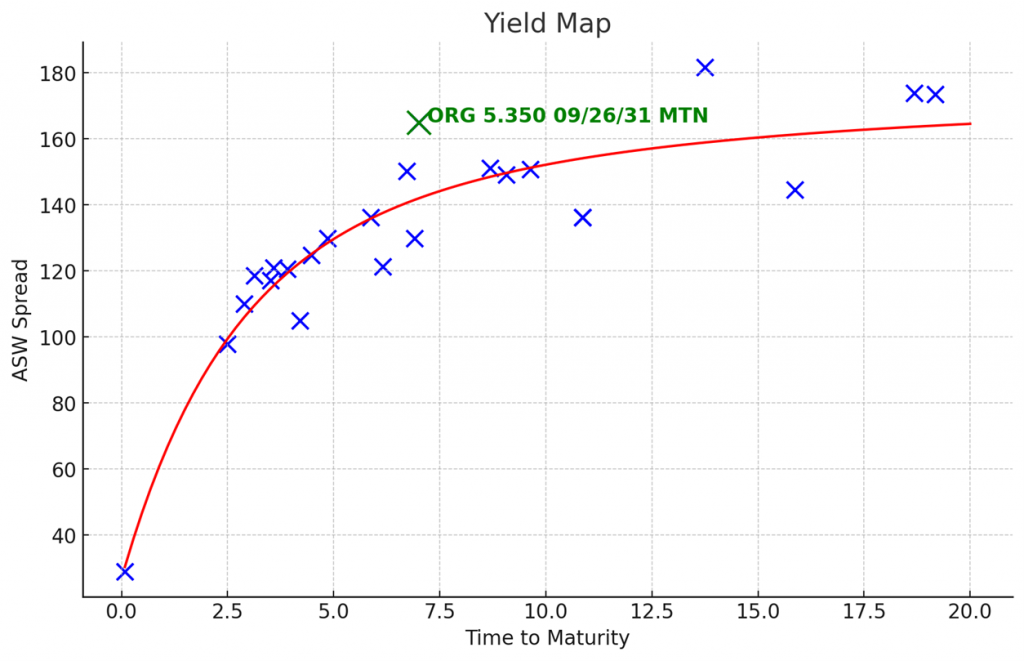

The bond’s pricing reflects a strong market position. As depicted in the yield map, the bond (highlighted in green) sits slightly above the red yield curve, indicating it offers a competitive spread relative to other bonds with similar maturities. The spread of 165 basis points for Origin’s bond is marginally higher than the average for bonds in the 5 to 10-year maturity range. This reflects investor confidence in the company’s solid credit profile, while offering an attractive premium in the current market environment. Origin’s strong credit metrics and robust investor demand position this bond issuance well among its peers.